ROBOT FARMERS

Agriculture 4.0 and the rise of robotic farm hands

For each farmer under the age of 35 in Europe, there are nine farmers over the age of 55. Spain, France, Germany, Italy and the UK all face farm worker shortages in the hundreds of thousands during key harvest seasons. Across Europe, around two thirds of farmers have no successor to take over their farm.

Compounding this problem is the triple threat of climate change, environmental degradation and rising food demands. Farming is facing an uncertain future –– if nothing changes.

A wave of startups is seeking to alleviate these problems using rapidly improving robotic technology to assist farmers to not only automate more work, but also to farm more efficiently, using less chemicals and creating less waste.

The European Circular Bioeconomy Fund (ECBF) takes a deep dive into the fertile world of autonomous farming, exploring the challenges and opportunities ground-based robotics and farm automation offer. This report identifies the key factors driving growth of companies in the sector, the main issues they seek to solve and the venture dynamics across the investment landscape. Also, will farms ever become fully automated?

Let’s cut to the chase on the last question. Terrestrial farms are incredibly complex operations that require expertise on many different levels about many different processes. So in the short term at least, probably no.

Then again, at ECBF the belief is that many labour and chemical intensive farm activities can be massively improved by the use of automation and farm robots. Thanks to the insight of Mogens Rüdiger (AgroIntelli), George Varvarelis (Augmenta), Simon Aspinall (Ecorobotix), Gaëtan Severac (Naïo Technologies) and ECBF’s own Stéphane Roussel, Hakan Karan, Ananya Manna, Julia Seeliger for the creation of this report.

Lay of the Land

First off, this report deals exclusively with farm robots, or more precisely mobile, autonomous, and decision-making mechatronic devices that perform tasks with limited supervision. In simple terms, robotic replacements of tractors and farm labourers that function more or less autonomously on the ground.

Tasks include weeding, fertilising, seeding, harvesting, pest control and fertigation the precise application of water and nutrients, while leveraging advances in image recognition, sensor technology and precision localisation.

When used effectively, (semi-)autonomous farm robotics can yield advantages in reducing required person-hours, water, fertiliser and pesticide use and workplace accidents. This, in turn, increases efficiency, meaning higher crop yields and optimisation of resources, and higher margins for farmers.

Automation is increasingly needed, as ageing farmers are facing increasing labour shortages, energy costs, while at the same time facing changing consumer attitudes towards farm chemical usageand environmental challenges driven by global climate change.

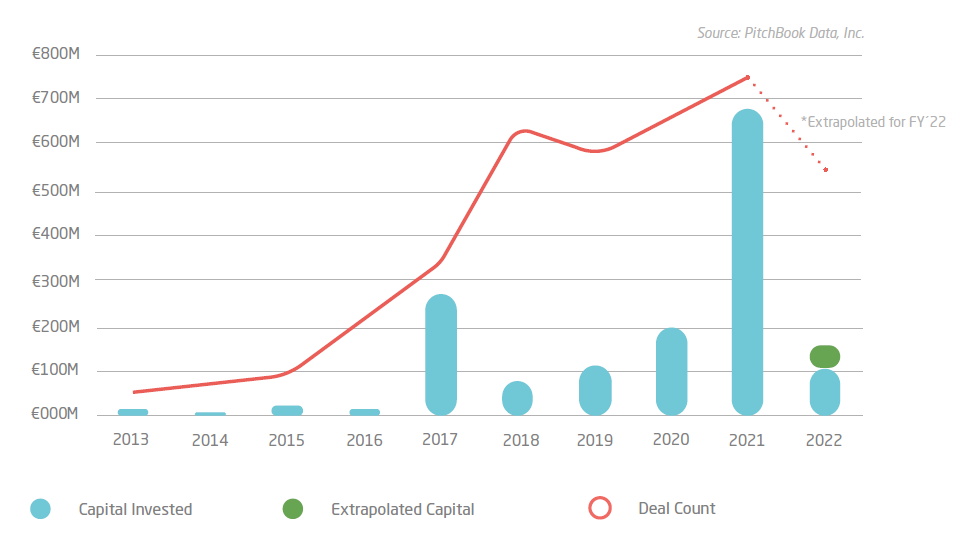

These compounding necessities are driving a booming farm robotics market, which is expected to increase at a CAGR of 34.4% to reach almost $100 billion in 2030. As labour costs rise and robotics costs fall, deal count and invested capital soared to a new high in 2021, with over €700 million invested over 70+ deals.

Adoption of farm robotics still faces significant challenges. First off, farmers are still sceptical of the high up-front investment required for non-subscription technology, with concerns over longevity and lack of interoperability with existing farm equipment. Second, lack of concrete regulation of autonomous farm technology and ownership of data it produces introduces risk into farmers’ investment in high-tech robots.

Nevertheless, startups are now the dominant force in farming innovation, with a portion of them reaching make-or-break maturity. The number of startups founded peaked in 2017, with the sector now slowly moving into a high-growth phase, most likely followed by an M&A-driven consolidation phase.

In the short term growth in the sector would most benefit from clearer regulation, favourable policy changes and increased exposure of novel technology among farmers.

THE RISE OF AGRICULTURAL ROBOTS

Here’s a staggering fact. By 2050, the world’s population will have increased to 10 billion. Common sense would be that an increase of the population of 25% should lead to an increase of farm food production by 25%.

Common sense would be wrong. According to a report by the World Government Summit, farmers in 2050 will need to produce 70% more food to keep everybody fed.

That is a big problem, as agriculture all over the world is facing a number of threats that are pushing farm productivity down.

First, land degradation from erosion and excessive chemical use on farms is causing undue stress on natural resources like water and fertile soil.

Second, climate change is leading to greater variability in weather and precipitation, decreasing yields.

And finally, a consistent shortage of farm workers combined with an ageing population of farmers in Europe and the US is putting stress on production capabilities.

Enter Agriculture 4.0.

ROBOTS ON THE FIELD

As with most disruptive advances, Agriculture 4.0 promises to more efficiently utilise scarce resources by applying technology to processes that can be improved –– ‘disruption’ of traditional farming.

The concept ranges from better utilisation of data collected by sensors, satellites and drones to more accurately keep track of increasingly precise metrics –– e.g. irrigation levels of individual plants –– to using robots on the field that can not only alleviate labour shortages, but also more precisely and continuously care for crops.

This need for automation is a huge opportunity for startups developing AgTech solutions, not only in the sense that there is a wealth of processes that could use improvement, but also financially. The FAO estimates that to eliminate world hunger by 2030, $238 billion have to be invested annually in improving farm productivity.

Robots have a big part to play in this. Farming crops is not only some of the most labour-intensive work, it’s also dangerous. In the USA, agriculture is the second leading industry in workplace accidents. In Europe, it’s no different. In the UK, for instance, fatal injuries occur 21 times as frequently per 100,000 workers as in the average across sectors.

A recent article published on the website Equal Times highlighted the problems faced by agriculture workers, many of which are undocumented. “We suffer from health problems related to working in agriculture: back pain, neck injuries, lumbago, musculoskeletal conditions, and, because of our exposure to agrochemicals, headaches, stomach problems and allergies,” one of the workers they spoke to told the website.

Other concerns exist around the exposure of farm workers to chemicals in pesticides. A 2021 report by Earthjustice cited in the article “concluded that farm workers in at least eight US states are at risk of developing neurological problems due to prolonged exposure to organophosphate pesticides.”

Robots don’t tire, don’t develop chronic diseases and can work under challenging weather conditions. Thanks to advances in sensor technology, some farm robots can weed more precisely or apply water and nutrients exactly in the quantities needed per plant. Other automation technology can be connected to existing tractors, eliminating the need for a human driver and ensuring compatibility with farm equipment –– all while mapping fields, weeds and crop performance.

TOWARDS THE AUTONOMOUS FARM

That last bit offers some interesting and novel business opportunities for startups.

Augmenta, a Greek AgTech startup founded in 2016, offers tractor automation by mounting an array of sensors on top, including normal cameras for navigation, but also multispectral sensors that can spot diseased crops and measure soil water content.

The automation kit can be bought together with a suite of services to map fields and crops, and the company also offers subscription services that allow for more advanced use of the data collected by the tractor-mounted sensors –– from automated and precise fertiliser application to precision pesticide spraying.

The more precise application of chemicals to promote crop growth –– whether those are pesticides, fertilisers or water –– is known as Variable Rate Technology (VRT), and has been gaining steadily in popularity among farmers. Instead of spraying a whole field, or parts of it, machine vision can be used to identify exactly which plants should be addressed, massively cutting down on resource usage and risks to farm workers while improving soil health, biodiversity and profitability of farms.

Advances in farm robotics are driven by three major technological factors

Sensing/Perception: improvements in performance of sensors capable of multispectral analysis of visual data, combined with big data analytics allow for near real-time processing of data collected by robots or autonomous tractors. This in turn enables machines to accurately administer herbicides, pesticides, fertilisers and/or water.

Location mapping: GPS offers positioning up to a resolution of around 5 meters, which is not sufficient for localising individual plants. Combining visual data with GPS currently allows for Realtime Kinematic Positioning (RTK), which enables precision mapping and positioning of robots to the centimetre level.

Variable Rate Technologies (VRT): Where previously whole fields or sections of fields were sprayed with necessary chemicals, the combination of improved sensing and positioning now allows chemicals or water to be applied to the needs of individual plants, vastly reducing the need for them.

VRT also is where other startups in the field seek their advantage. Swiss outfit Ecorobotix, founded in 2011, developed a tractor-pulled device that precisely sprays herbicides and pesticides on weeds where needed. According to the company, it can achieve a 95% reduction in the use of those chemicals.

Danish startup AgroIntelli takes a slightly different approach, by developing a relatively lightweight tractor replacement robot that allows existing tractor implements to be attached to it.

Mogens Rüdiger, chairman of AgroIntelli: “We rely on the multitude of implement manufacturers that exist around the world. We think that by being able to attach our robot with a standard implement, we make this technology development easier for the farmer to comprehend and to accept.”

Rüdiger hits on an important challenge here; the fact that farmers, who operate on thin margins with few resources to invest in expensive high tech robots, are overall quite conservative when it comes to adopting new technology. By allowing existing machinery to be hooked up to their robot, the company hopes to bring the adoption barrier down.

Ecrorobotixs´tractor pulled precision spraying device. Source: Ecroroboticx

UNINTENDED CONSEQUENCES AND UNKNOWN RISKS

Apart from the investment costs, farmers are hesitant to quickly jump on to the robot bandwagon for a number of different reasons.

First, as you may have surmised, all of these startups rely on the collection of data to feed their algorithms to improve performance. That raises the question of data ownership and if farmers are willing to share the variables that go into producing crops.

Take wine makers, for instance, who sometimes have very specific rules on when harvests are done to ensure a particular quality and taste of their grapes. Would their trade secrets be safe if they’re using a grape tending robot? Rules around the use of data are sometimes unclear, presenting a barrier for adoption for farmers.

Regulation, or lack thereof, is another concern facing agriculturalists looking to buy into farm robots. Both in the US and EU, policy makers haven’t consistently addressed these new agricultural advancements.

In the EU farm robots are regulated through the 2006 Machinery Directive, which hasn’t seen meaningful updates since its adoption. The directive requires a human hand behind the wheel of agricultural vehicles, meaning even an automated tractor does not significantly free up person hours.

A recent paper by the University of Copenhagen’s Department of Food and Resource Economics and others therefore calls for regulatory reform to allow these (semi-)autonomous vehicles to be used effectively. “However, as the rules stand, only large farms would be able to introduce these technologies in the years to come as monitoring would be prohibitively expensive. In order for small and medium-sized farms to benefit from robots, a farmer must be able to remotely monitor several robots,” co-author Associate Professor Søren Marcus Pedersen of the Department of Food and Resource Economics said.

Similar regulations apply in the US, with the exception of California, which has created rules for the use of autonomous robots, but still requires a human present at all times to intervene when problems occur. Regulators seem unwilling to budge from this position, as demonstrated in a 2022 ruling against Monarch Tractor, an autonomous tractor developer. The company was denied permission to expand the use of its autonomous tractors outside of two wineries where they were being piloted.

Australia appears to be the front-runner in terms of regulation, in the sense that they have very few to allow experimentation with robotics.

Another barrier to adoption is the unknown life-span of farm robotics. Tractors, when well maintained, can last up to 25 years. For farm robots, which haven’t been around that long, and especially not in constant operation, life span remains uncertain, making a farmer’s investment decision risky.

Macro-societal consequences play a role in large-scale adoption as well, foremost being the desirability of replacing a source and income for a large group of people. Second, worries exist that rather than the ecological utopia presented by startups, the adoption of robots and their limited capabilities will lead to the creation of mega-farms autonomously producing monocultures, as the limited on-farm variability will be more manageable for autonomous equipment.

VENTURE LANDSCAPE

The AgTech sector has seen an increasing deal count up to the latest data from 2021, steadily growing from 87 deals in 2011 to 751 in 2021, according to data on VC activity published by Pitchbook.

As expected, big industrial players in the market have played a large role in both investment and acquisitions.

The largest acquisitions in the agricultural robotics industry to date were both by the American agricultural machinery corporation John Deere, which acquired US-based precision weed control startup Blue River Technology in 2017 for $284 million, followed by the acquisition of Bear Flag Robotics in 2021 for $250 million.

More recently, two French ag-robotics companies were acquired in 2022, with British SDF Agriculture taking a majority stake in Vitibot, a company that develops vineyard robots, and US conglomerate Trimble acquiring Bilberry, a French technology company specializing in selective spraying systems for sustainable farming.

Agro-chemical corporations are well represented among investments in farm robotics, with a marked (and predictable) preference for spraying and weeding companies. Bayer and Syngenta were both investors in the aforementioned Blue River Technology, with BASF and FMC investing respectively in Ecorobotix and TartanSense.

In terms of investment maturity, startups in the steering and weeding sectors lead the pack, with multiple companies raising Series B and Series C rounds (Blue White Robotics and Carbon Robotics, Naio and Ecorobotix).

According to ECBF investment analysts, the sector has moved into a high growth phase, in which investments follow customer acquisition. This phase will be followed by a consolidation phase, with increased M&A activity from both corporates and between startups.

In all, agricultural robotics still have a ways to go before becoming commonplace. Along the way, kinks in both the technology and regulations have to be worked out. But the payoff is potentially huge: less people needed to do strenuous farm work, leading to less injuries, and more efficient farms that use a fraction of the resources.

ECBF’s commitment to the transition to a more sustainable future, for farm workers, the environment and investors alike, leads us to believe in the potential of using robotics in agriculture to provide food security and better working conditions and financial returns to match. We seek to be a significant financial instrument and partner for entrepreneurs looking to unlock and accelerate the economic potential of the circular bioeconomy in Europe, and help create a better and healthier future for everyone.

For questions and comments, please refer to

Stéphane Roussel, Partner at ECBF

stephane.roussel@ecbf.vc

Ananya Manna, Investment Director at ECBF

ananya.manna@ecbf.vc

Hakan Karan, Associate at ECBF

hakan.karan@ecbf.vc

Julia Seeliger, Analyst at ECBF

julia.seeliger@ecbf.vc

Cornelia Mann, Marketing & Communications at ECBF

cornelia.mann@ecbf.vc