Treating soil like soil:

Regenerative agriculture

How regenerative agriculture and carbon credits could be the key to sustainable farming and environmental restoration.

Regenerative agriculture is emerging as a transformative approach to farming that not only enhances soil health but also combats climate change through carbon sequestration. As the world grapples with environmental degradation and the pressing need for sustainable food systems, regenerative practices offer a promising solution. By integrating carbon credits and fostering collaborative efforts among stakeholders, we might be on the cusp of a revolution in how we produce food and steward the land.

Executive Summary

REGENERATIVE AGRICULTURE DEFINED

Regenerative agriculture is a farming approach that restores and enhances soil health, biodiversity, water resources, and climate resilience. Unlike conventional methods, it focuses on outcome-based practices tailored to local contexts, aiming to leave the land better than it was found.

KEY COMPONENTS

• Soil Health: Improving organic matter and microbial activity to enhance fertility.

• Biodiversity: Promoting diverse ecosystems on farmland, below the surface as well as above the surface, to support wildlife and plant diversity.

• Carbon Sequestration: Capturing atmospheric carbon in soils and vegetation to mitigate climate change.

• Water Management: Enhancing water retention and reducing runoff to conserve water resources.

CHALLENGES AND SOLUTIONS

• Financial Barriers: Transitioning to regenerative practices requires upfront investment.

Solution: Leveraging carbon credits and financial incentives to support farmers.

• Measurement and Verification: Difficulty in quantifying soil carbon and ecosystem benefits.

Solution: Developing advanced MRV (Measurement, Reporting, and Verification) technologies.

• Market Development: Lack of standardized markets for carbon and biodiversity credits.

Solution: Establishing clear frameworks and regulations to facilitate trade.

POLICY AND INDUSTRY INITIATIVES

• The European Commission is promoting carbon farming through policy frameworks.

• Industry players like Bayer are committing to regenerative agriculture and supporting innovation.

FUTURE OUTLOOK

• Regenerative agriculture has the potential to become mainstream with the right financial models, technological support, and collaborative efforts.

• Integration of carbon credits and biodiversity credits can create new revenue streams for farmers, incentivizing sustainable practices.

In the face of escalating climate change, biodiversity loss, and soil degradation, the way we produce our food has never been more critical. Traditional agricultural practices have contributed significantly to environmental challenges, including deforestation, greenhouse gas emissions, and the depletion of soil fertility. As the global population continues to rise, expected to reach nearly 10 billion by 2050, the demand for food will only intensify these pressures unless transformative changes are made.

Regenerative agriculture emerges as a beacon of hope in this context. It is a holistic land management practice that seeks not just to sustain but to regenerate and revitalize the soil and the entire ecosystem. By focusing on restoring soil health, enhancing biodiversity, improving the water cycle, and increasing resilience to climate instability, regenerative agriculture offers a pathway to reverse the adverse effects of conventional farming.

The importance of regenerative agriculture lies in its potential to address multiple global challenges simultaneously. It can sequester significant amounts of atmospheric carbon dioxide, thereby mitigating climate change. Healthier soils lead to more nutritious crops, which can improve human health. Enhanced biodiversity supports ecosystem services essential for life on Earth, such as pollination, water storage and natural pest control. Moreover, regenerative practices can improve farmers' livelihoods by reducing input costs and increasing resilience to extreme weather events.

Incorporating carbon credits into regenerative agriculture amplifies its impact. By monetizing the carbon sequestration achieved through regenerative practices, farmers receive financial incentives that support and encourage the adoption of these methods. This integration creates a synergy between environmental restoration and economic viability, making regenerative agriculture a compelling solution for sustainable food production and ecological conservation.

The Farmer´s Perspective

Maarten van Dam , partner in the investment fund Pymwymic and a regenerative farmer from the Netherlands, embodies the shift from conventional to sustainable farming – with an affinity for finance.

After years of operating large-scale farms with heavy machinery, he transitioned to regenerative permaculture on a 20-hectare farm. By focusing on perennials and mimicking natural ecosystems, van Dam not only improved soil health but also enhanced biodiversity and water retention on his land.

Van Dam acknowledges that regenerative agriculture is still not widely practiced. "I think less than one percent of the farming practices you can call regenerative," he notes. "Part of the challenge comes from the confusing terminology. There’s a mix of terms - regenerative, organic, biodynamic - and it’s not always clear what each one means. Having better definitions would be very helpful," he explains.

One of the significant barriers van Dam identifies, and actively works on, is the lack of financial proof that regenerative farming can be viable. "Farmers have not seen any proof that these kinds of farming systems are actually financially viable because it takes five, six, seven years at least, and then the outcome is still unknown," he says. The initial years can be challenging, and without guaranteed returns, it's difficult for farmers to take the risk.

He describes the situation as a "chicken and egg" problem. "Some chickens should build proof points... that it can become financially viable," he suggests. Van Dam and his team are working on creating these proof points by demonstrating the long-term profitability of regenerative practices. "Our Excel sheets and models are very promising, so we hang on to that and hope that in seven years we make a better margin, a better profit than conventional farmers," he shares.

Van Dam also highlights the imbalance in the risk-reward profile for farmers. "They are asked to take a lot of risk, and at the same time, the reward is not balanced towards the farmers," he observes. To address this, he sees potential in monetizing ecosystem services. "Creating carbon credits or creating a carbon credits market, a biodiversity credits market, and a water credits market... that would be extremely helpful," van Dam states. By providing financial incentives through these markets, farmers could improve their position and be more inclined to adopt regenerative practices.

Ultimately, van Dam’s goal is to inspire other farmers by showcasing successful examples. "Creating proof points and showcasing to other farmers how to convert to more regenerative practices is actually one of our main focus areas," he reiterates. He is optimistic that once financial viability is demonstrated, more farmers will join the movement. "As soon as we have reached that level... I really hope and think that a lot of farmers will join," van Dam concludes.

The Role of Carbon Credits

As van Dam highlighted, financial incentives play a crucial role in encouraging farmers to adopt regenerative practices. One way of providing these incentives could be through carbon credits.

A carbon credit represents the reduction or removal of one metric ton of carbon dioxide or its equivalent in other greenhouse gasses. Farmers earn these credits by implementing practices that enhance carbon sequestration, such as cover cropping, reduced tillage, or agroforestry. Once verified, these credits can be sold on carbon markets to companies and organizations seeking to offset their own emissions, effectively creating a market-driven approach to reducing global greenhouse gas levels.

Buyers are typically businesses aiming to meet voluntary sustainability goals or comply with regulatory requirements. The carbon credit market is regulated by a combination of international bodies, national governments, and independent certification organizations.

In the European Union, the European Commission is developing regulations to ensure the integrity and transparency of carbon markets. Prices for carbon credits can vary widely depending on factors like market demand, the method of sequestration, and verification standards, but farmers may receive anywhere from €20 to over €100 per ton of CO2 equivalent sequestered. This financial incentive can significantly enhance the economic viability of adopting regenerative agricultural practices.

Speaking during the Deep Dive, Head of Unit for Land Economy and Carbon Removals Christian Holzleitner from the European Commission’s DG CLIMA emphasizes the importance of setting quality criteria for carbon removal projects. These criteria include ensuring accurate quantification of carbon sequestered, demonstrating additionality (meaning the carbon sequestration would not have occurred without the project), ensuring the permanence of carbon storage, and maintaining sustainability throughout the process.

Moreover, the Commission is developing certification methodologies to standardize how various carbon farming practices are assessed. This standardization is essential for building trust in the market for carbon credits, as it ensures that credits represent real, verifiable carbon sequestration. Market transparency is another focus area, with efforts underway to facilitate the creation of transparent markets for carbon credits. Such markets would enable farmers to sell their credits more easily and allow companies seeking to offset their emissions to purchase credits with confidence.

"We need to empower our farmers to take care of their carbon balance," says Holzleitner. By providing farmers with the necessary information, tools, and advisory services, they become integral players in climate action, while benefiting financially.

BUT how can carbon storage be measured?

One of the critical challenges in regenerative agriculture is the lack of standardized definitions and measurements. Dionys Forster, representing the Sustainable Agriculture Initiative (SAI) Platform, is actively working to address this issue by developing a comprehensive framework for regenerative agriculture. The framework aims to provide clear definitions, principles, and metrics that can be universally applied, taking into account regional variations in farming practices and environmental conditions.

Forster emphasizes the importance of regional context in implementing regenerative practices. "A farmer in the Netherlands is not the same as one in Spain," he points out. By acknowledging these differences, the framework seeks to tailor regenerative practices to local conditions, ensuring that they are relevant and effective for farmers in different regions.

The SAI Platform's framework focuses on outcome-based measurements rather than activity-based ones. This shift enables a more accurate assessment of the actual impacts of regenerative practices on soil health, biodiversity, and carbon sequestration. By standardizing these measurements, the framework facilitates better reporting, verification, and comparison across different projects and regions.

By developing this standardized but customisable framework, the SAI Platform aims to support the scaling up of regenerative agriculture globally. It provides a foundation for policymakers, industry players, and farmers to collaborate effectively.

Ultimately, Forster and the SAI Platform are contributing to the creation of a unified approach that can accelerate the transition to sustainable and regenerative farming systems worldwide – and create buy-in from industry.

Industry Commitment

Major industry players are recognizing the potential of regenerative agriculture and are committing resources to support its adoption. Bayer, a global leader in agricultural inputs, is one such company making significant strides in this area. Karl Collins from Bayer’s open innovation and strategic partnerships, outlines the company's approach to integrating regenerative practices into their business model.

Bayer views regenerative agriculture as an evolution of sustainable agriculture, building upon existing practices to deliver positive benefits to nature rather than merely reducing negative impacts. The company is therefore investing in advanced technologies such as next-generation seeds and traits, biologicals, and digital solutions that support farmers in implementing regenerative practices effectively.

Collins says that supporting farmers is a key component of Bayer's strategy. By providing tailored solutions, Bayer aims to help farmers improve yields and productivity while enhancing ecosystem services like soil health and biodiversity. This support includes offering climate adaptation solutions and exploring new sources of revenue for farmers, such as carbon credits.

Like Forster’s SAI Platform, Bayer is also shifting towards outcome-diven production models. Instead of focusing solely on the inputs provided to farmers, the company is looking at the tangible benefits achieved through regenerative practices. This includes improving soil health as a primary objective, which leads to increased resilience. Other key aspects and benefits include mitigation of climate change through greenhouse gas emissions reductions and increased carbon removals, maintaining, preserving or restoring on-farm biodiversity as well as conserving water resources. But also looking at the whole value chain, from seeds and fertilizers, to collecting more data for better and smarter decision making, to producing the proteins for alternative sources.

“For us, regenerative agriculture includes a combination of solutions to create economic and social value, new sources of revenue, and positive outcomes for the future. So it's about producing more while restoring more”, he says.

"Regenerative agriculture builds on sustainable agriculture and has many of the same aims," Collins notes. The company's commitment fits into a broader industry trend towards embracing regenerative practices as a means to produce more while restoring more. This approach aligns economic goals with environmental stewardship, possibly demonstrating that profitability and sustainability can go hand in hand.

Industry Technological Innovations in measurements and markets

Bayer’s commitment is echoed by startups working on the challenge of measuring how much carbon is sequestered in soil.

AgriCircle is one company at the forefront of developing precise measurement tools. Daniel Markward, former co-founder of AgriCircle, emphasizes the importance of precision in measurement.

"We claim that we have the most precise measurement solution in the market when it comes to soil health using remote sensing," he states. By leveraging remote sensing technology and soil analysis, AgriCircle provides detailed assessments of soil health indicators.

This outcome-based approach helps farmers understand the direct impact of their practices on soil organic matter, microbial activity, and overall ecosystem health. The data collected not only aids in farm management decisions but also facilitates participation in carbon credit programs by providing the necessary verification of carbon sequestration.

Similarly, companies like Seqana are harnessing advanced technologies to make carbon monitoring more accessible and cost-effective. Stefan Gönner, co-founder and CEO of Seqana, says that the company aims to “help project developers and Agrifood corporations optimize their investment in soil carbon MRV for long term returns."

By utilizing satellite imagery combined with machine learning algorithms, Seqana estimates soil carbon levels across vast agricultural landscapes and creates bespoke soil sampling and MRV routines. This technological innovation ensures that every direct soil sample taken contributes to the ROI of the program. “We can increase claims for carbon removals drastically, finding the economic optimum that weighs the value of each soil measurement against its marginal benefit” says Gönner. “That’s really the value proposition we’re currently offering.”

Such advancements in measurement technology are vital for scaling up regenerative agriculture. They provide the necessary data to validate carbon credits, ensure transparency in the market, and build trust among stakeholders. But for carbon credits to deliver, there also has to be a robust market, which is what the third startup presenting during this Deep Dive is working on.

At ReGeneration, CEO Thomas Rabant, who has a background in M&A and finance and led the strategy and development of a global agicultural leader, they’re building a two-pronged approach to creating this market. "We all know that the transition of agriculture has a significant cost. The key question is, for all the value chain, how to finance this gap and these needs to build regenerative agriculture at a large scale," he says.

First, the company understands that transforming agriculture requires a hefty investment from the farmer’s end – which van Dam also pointed out.

He puts the number at more or less 100 euros per hectare. ReGeneration therefore offers “a good level of pre-financing of the transition in order to precisely tackle their financial needs.”

On top of that, the startup offers agronomy on the ground and guidance on how to best invest and manage the fanancing in the long-run so the transition can actually succeed.

With the transition in place, the company developed a “new tool, which we call climate contribution credits,” Rabant says. The credits, based on real measurements, not only cover carbon capture, but also improvements in biodiversity and water resources. “We think robust and holistic assessment is the expectation of the market, and we deploy it on the ground,” Rabant adds.

Understanding the investment landscape in regenerative agriculture and carbon credits provides valuable insights into the sector's growth and challenges.

Venture Dynamics

The European Circular Bioeconomy Fund (ECBF) conducted an extensive analysis of the field, identifying 101 startups globally that are working on regenerative agriculture and carbon credits. These startups were categorized based on their position in the value chain:

• MRV (Measurement, Reporting, and Verification): Startups that focus on measuring, verifying, and reporting carbon reductions. This category has the highest concentration of companies.

• Regenerative Programs: Startups offering holistic approaches to farmers, guiding them from farm assessment to carbon credit generation and sales.

• Project Developers: Companies that develop and implement specific regenerative agriculture projects, focusing on planning and execution.

• Marketplaces: Platforms where carbon credits are sold and traded.

• Consulting: Firms providing tailored advice to farmers.

• Standards and Intermediaries: Organizations focusing on setting standards for calculating carbon practices and ensuring quality.

• Others: Startups operating across multiple areas of the value chain.

Geographical Distribution

• Europe: A significant number of startups are based in Europe, particularly in France, Germany, the Netherlands, and the UK. France has a higher concentration of project developers, while Germany has more marketplaces.

• North America and Australia: There are fewer startups, but they have attracted more funding compared to their European counterparts.

• Livestock Focus: Only a small number of startups (7 out of 101) focus on livestock, indicating potential growth opportunities in this sector.

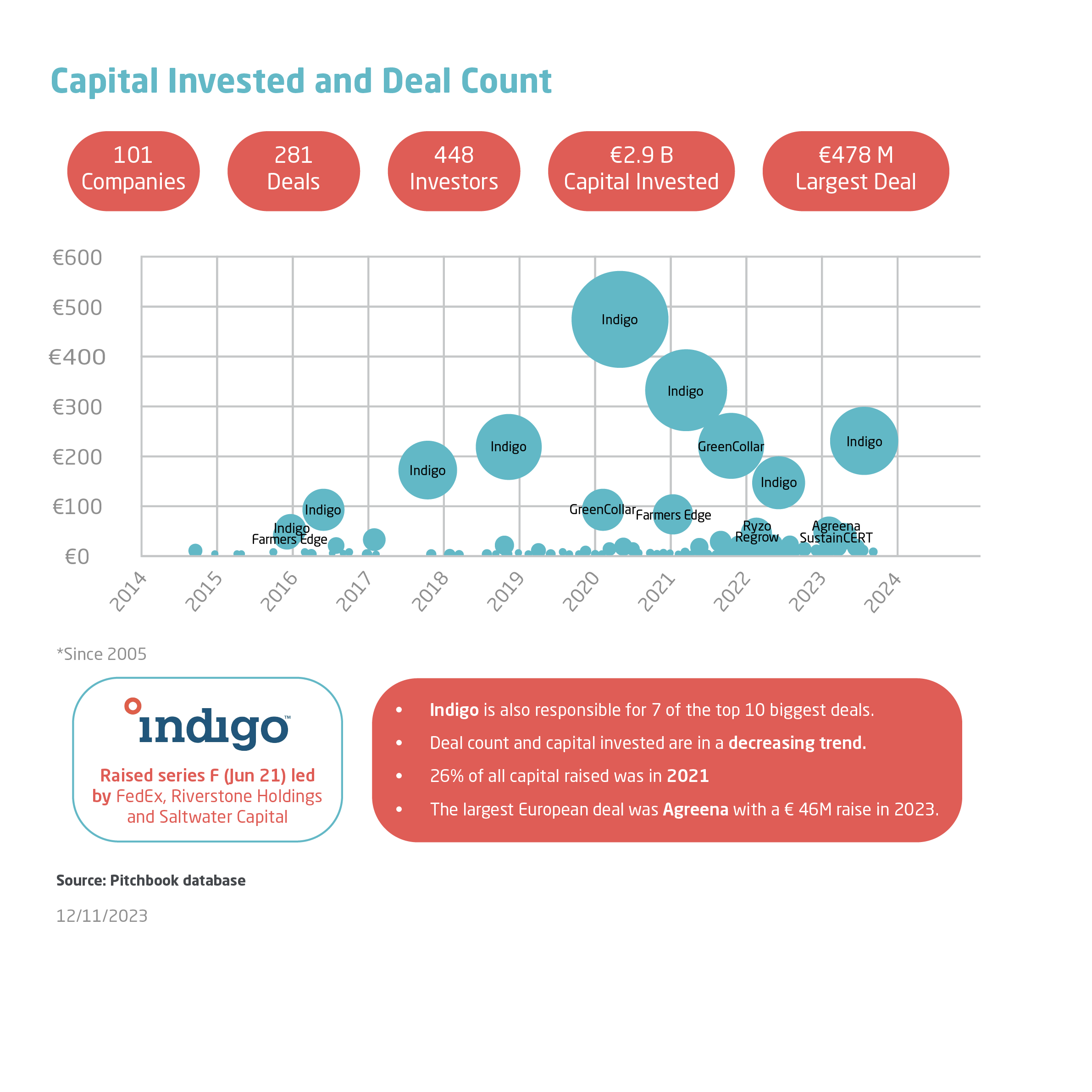

Growth and Saturation: Interest in the sector accelerated after 2016, peaking in 2020 and 2021. There is now a decreasing trend, possibly due to market saturation and large agri-food companies launching their own carbon programs.

Capital Investment: A total of €2.9 billion has been invested across 281 deals. Indigo Agriculture, a U.S.-based startup offering regenerative programs, accounts for 7 out of the 10 largest deals in the sector.

Market Correction: Some startups, like Indigo Agriculture and Farmer's Edge, experienced significant drops in valuation, reflecting a market correction from earlier high valuations and overpromising.

Partnerships and Investments: Large agri-food companies are

highly interested in carbon farming and have developed their

own programs. They also partner with startups to enhance their

offerings.

Non-Food Companies: There is notable investment from nonfood

companies aiming to offset emissions and support sector

development.

Mergers and Acquisitions: Market consolidation is occurring, with

examples like private equity firms acquiring stakes in startups like

GreenCollar.

Challenges Identified

Financial Incentives: While farmers are open to regenerative practices due to economic incentives, these incentives are sometimes insufficient, and upfront costs are high.

Measurement Difficulties: Quantifying soil carbon and sequestration is challenging due to soil heterogeneity, measurement inconsistencies, sensitivity to environmental and land-use changes, and unpredictable intense weather events.

Market Oversaturation: An oversaturated market with many startups offering similar value propositions makes it difficult for investors to distinguish unique offerings.

Regulatory Environment: The market is moving toward insetting (carbon reductions traded within a product's supply chain), but there is a lack of historical pricing references and established commercial structures.

Future Trends

Investor Focus: There is a shift towards profitability and lower valuations, with investors becoming more cautious.

Market Consolidation: Startups are strong in their core geographies but struggling to expand may lead to mergers and acquisitions.

Regulatory Influence: New regulations, especially around the disclosure of Scope 3 emissions (indirect emissions in a company's value chain), are expected to drive market growth.

This analysis underscores the dynamic nature of the regenerative agriculture sector, highlighting both the opportunities and the complexities involved in scaling sustainable farming practices.

Future Outlook

The integration of regenerative agriculture with carbon markets holds significant potential for transforming the agricultural sector and contributing to global climate goals. As measurement technologies continue to improve, it will become easier and more cost-effective to quantify the environmental benefits of regenerative practices.

This advancement will enable more farmers to participate in carbon credit programs, providing them with additional revenue streams and making the transition to regenerative agriculture more economically viable.

Van Dam, from the farmer’s perspective, agrees: "They don't have a lot of freedom to act, and they don't have the means to act." A financial mechanism could help: "I think it would be great to use these carbon, biodiversity, and water payments, monetizing systems, to actually improve the position of farmers."

Policy support is likely to play a crucial role in the future expansion of regenerative agriculture. Government initiatives, such as subsidies, tax incentives, and research funding, can provide the necessary frameworks and incentives to encourage adoption. Regulatory bodies can help standardize practices and ensure the integrity of carbon markets, fostering greater confidence among investors and participants. Christian Holzleitner from the European Commission underscores the importance of focusing on practices with multiple benefits: "I would first focus on those types of activities of carbon farming... that have this triple win that are good for climate, good for biodiversity, and good for the fertility of soil."

Beyond carbon sequestration, regenerative agriculture offers holistic benefits that align with broader environmental and social objectives. Practices that improve soil health also enhance biodiversity, increase water retention, and bolster resilience against climate extremes such as droughts and floods. These co-benefits contribute to ecosystem restoration and can have positive impacts on food security and rural livelihoods.

Consumer demand is another factor that may drive the growth of regenerative agriculture. As awareness of environmental issues increases, consumers are showing a preference for products that are sustainably produced. This shift in consumer behavior can create market incentives for companies to source products from farms employing regenerative practices, further encouraging adoption.

Collaboration among stakeholders—including farmers, agribusinesses, policymakers, scientists, and consumers—will be essential for realizing the full potential of regenerative agriculture. Shared knowledge, resources, and innovation can help overcome existing barriers and accelerate progress.

While challenges remain, the future outlook for regenerative agriculture is promising. By combining technological innovations, supportive policies, and market mechanisms like carbon credits, there is a significant opportunity to create a more sustainable and resilient agricultural system that benefits both people and the planet.

ECBF´s Commitment

ECBF’s commitment to the transition to a more sustainable future for consumers, the environment and investors alike, and in-depth analysis of the sector leads us to foresee several investments in the field. We seek to be a significant financial instrument and partner for entrepreneurs looking to unlock and accelerate the economic potential of the circular bioeconomy in Europe, and help create a better and healthier future for everyone.

Authors

-

Stéphane Roussel

Partner

-

Hakan Karan

Associate

-

Giulia Tegas

Anaylst