Fermenting the Future

Precision Fermentation

How genetically modifying organisms to become biological mini-factories could be the “most important environmental technology ever developed,” according to some.

ECBF’s precision fermentation Deep Dive takes us into the astounding possibilities offered by naturally occurring and genetically engineered microbes to produce compounds with various applications in food (dairy protein, fats, colourants), personal care & home care (lipids, active ingredients), packaging, even textiles (dyes).

Precision fermentation could possibly be the biggest environmental technology invented by humans. By using microbes as ‘cell factories’ instead of livestock agriculture or petrochemicals, we might be on the cusp of a world that will look radically different from what we’re used to.

Executive Summary

Fermentation Technologies

Fermentation is a natural process where organisms metabolize carbon sources such as sugars or gases into other molecules.

Three main types: Traditional, biomass, and precision fermentation.

Precision fermentation is a production of specific target molecules through natural or genetically modified organisms.

Precision fermentation

While lacking a consensus definition, precision fermentation can be defined as: “a biotechnological production process on an industrial scale that uses customized productive organisms and intelligent bioprocesses to produce complex chemicals and active ingredients in a targeted manner.”

The range of possible producible compounds is very broad, from proteins to enzymes to food ingredients to pharmaceuticals and specialty chemicals.

Production of target molecules takes place in three steps: 1) designing the organism, 2) adding feedstock and running the fermentation process and 3) purifying the end-product.

Regulatory and Ethical Considerations

EU Novel Food regulations require a case-by-case analysis for food products produced through (precision) fermentation.

Concerns include consumer aversion to genetically modified products and potential corporate monopolies.

Fermentation feedstock remains a concern, as some feedstocks could compete with agricultural products fit for human consumption

Market and Startups

Numerous startups are using precision fermentation for various applications, including food and beverages.

Europe has double the fermentation volume of the US but the same number of

CMOs. More large-scale production sites. Germany is a leading hub for precision fermentation, followed by Denmark, UK and NL

Startups using second-generation feedstocks are maturing, creating a positive outlook for investments.

Future Outlook

Precision fermentation has the potential to significantly reduce the environmental footprint of food and chemicals’ production.

Back in the late 19th century, scientists were puzzled to find that human milk contains a wide variety of sugars that infants did not digest. Why would a mother expend energy on producing complex sugar molecules that would just pass unused through the baby’s digestive system?

The answer turned out to lie in the interplay between what we think of as ‘ourself’, and the organisms that inhabit our body.

Human milk contains a wide variety of so-called human milk oligosaccharides, or H.M.O.s, that play an essential role in how a baby’s body adapts to deal with microorganisms, like bacteria and viruses.

In 2006, a group of scientists discovered that the sugars in human milk were particularly geared towards feeding one type of bacteria, Bifidobacterium longum infantis, above all other common gut bacteria competing to colonize. The milk pretty much made sure this bacteria was fed enough to become dominant in the baby’s digestive system.

When metabolizing the H.M.O.s, B. infantis produces specific fatty acids, which feed the infant’s cells lining the gut and encourage them to produce adhesive proteins that make the gut lining denser – and thus less prone to let through disease-causing microorganisms.

Another wonderful property of H.M.O.s is that they closely resemble certain glycans, which are sugars on the outside of our internal cells. Harmful viruses like Salmonella, Listeria and the virus that causes cholera latch on to these glycans to infect cells and propagate. The glycans in human milk act as decoys for these viruses, causing them to latch on and pass through the gut without causing harm.

You get the point. H.M.O.s are great for babies. But successful breastfeeding isn’t a given, whether by choice or by nature. So a number of large corporations, including Nestlé, tried their hand at synthetically producing H.M.O.s to add to infant formula, but were ultimately unsuccessful in finding a process that scaled.

And here’s where the above story, colorfully told by Dr. Stefan Jennewein of Jennewein Biotechnologie – a major producer of H.M.O.s – acts as a useful illustration for the topic of ECBFs deep dive into precision fermentation.

Just like how the human body acts as a natural factory that produces a certain type of molecule for a particular purpose, humans have been using other organisms as natural factories to produce useful or wanted molecules through fermentation.

What is fermentation

Fermentation is a process in which an organism uses enzymes to metabolize carbon sources and chemically change the sugar molecule into another molecule.

It’s a process that happens everywhere in nature – e.g. in your gut – but has for thousands of years also been harnessed by humans to produce foodstuffs like alcohol or preservatives like lactic acid. Simply put, a microorganism eats some carbon-containing product, and produces something else.

In the case of citric acid, which is a naturally occurring substance in citrus fruits, it’s possible to harvest it from the fruit, but not very efficiently – it requires large amounts of fruit that need to undergo a three step chemical process to extract the acid in a useful form.

After the First World War disrupted the export of citrus fruits globally, Pfizer began large-scale industrial production of citric acid using Aspergillus niger, a type of mold, in the 1920’s.

So-called precision fermentation (PF) takes this whole process a step further.

Precision Fermentation

While a unified definition is still up for debate, precision fermentation boils down to a more advanced approach to traditional fermentation.

Tatjana Schwabe-Marković, Senior Project Manager at the Cluster Industrial Biotechnology (CLIB), who spoke during the Deep Dive, picked the following one: “Precision fermentation is a biotechnological production process on an industrial scale that uses customized productive organisms and intelligent bioprocesses to produce complex chemicals and active ingredients in a targeted manner.”

Or in other words, a more targeted approach to fermentation aimed at maximizing the output of the desired molecule at an industrial scale.

A common misconception is that this can only be achieved through genetic modification, but in fact, PF can also be done with naturally occurring genes. The ‘precision’ in precision fermentation is more about the focus on the efficiency and end-product.

“Rather than using the wild yeast present on grapes, hoping to produce a good wine, we use micro-organisms that might have been engineered to make the targeted compounds,” Schwabe-Marković says.

The range of possible producible compounds is very broad, from proteins to enzymes to food ingredients to pharmaceuticals and specialty chemicals.

Schwabe-Marković explains that the production process in PF broadly consists of three steps. The first is the design of the production strain, to ensure it grows and reproduces well and is sometimes stripped of genes that don’t serve productive purposes.

Second, this production strain is combined with feedstock in industrial fermentation vessels to start metabolizing and producing the desired end-molecule.

Third, and finally, the product needs to be purified – a step that according to Schwabe-Marković makes up for 70 to 80 percent of the production cost, depending on the intended end-use of the product. In this step the product is separated from contaminants or unwanted particles e.g. biomass (production cells) to the levels required by the market.

A whiff of success

Dr. Laurent Daviet, VP of Biotechnology, Natural Process Development and Health Innovation at fragrance and flavor manufacturer Firmenich – which merged with the Dutch company DSM to form dsm-firmenich in May 2023 – gave a few more concrete examples during the ECBF Deep Dive.

His talk focused mostly on how Firmenich has concentrated their efforts over the past 15 years on so-called ‘cell factories’ to produce high-price, low-volume ingredients for the perfume industry.

“First, we try to discover within a target organism the biological pathway that leads to the end product,” he said. This involves finding the enzyme that does the actual work, and the genetic information that encodes the enzyme. “Once this is done, we transplant this enzyme into a production host, and feed this host with a cheap source of carbon, such as sucrose, which allows the organism to produce the end-molecule we’re looking for.”

One of the results of these efforts has been the development of a commercial product called Dreamwood, an analogue of Sandalwood fragrance. “In the fragrance industry this is a huge molecule, which is distilled from the Sandalwood tree, with the best quality coming from the Santalum album species,” Daviet said.

The tree has been harvested, legally and illegally, to the point where it’s now an endangered species –– and this has severely limited supply, driving up cost.

“The key ingredients here are called alpha-santalol and beta-santalol. We did work to understand how this metabolite is produced in the plant,” Daviet explains. The company did over 100,000 unique genetic sequence analyses, in-vitro experiments and even grew a sandalwood tree in a greenhouse to access the roots.

They were able to characterize two key enzymes that could transform the precursors of both fragrant molecules into the molecule of interest. This genetic information was then inserted into baker’s yeast, and gas chromatography analysis showed that the result was nearly identical to the santalol produced by S. album – the molecule they were hoping to produce.

Dsm-firmenich is now also using AI in the discovery process for finding new fragrant molecules, for example to predict if a molecule is biodegradable. They also use AI to predict scent, “the holy grail for us remains to be able to predict olfactory properties based on molecular structure, we’re working on that.”

Synthetic biology

Precision fermentation isn’t a particularly new technique. It’s not even that complicated. There are home kits that allow amateurs to insert bits of genetic information into microorganisms, for example to express bioluminescence.

The first industrialized use was developed by biotech company Genentech back in the 1980’s, when they used fledgling recombinant DNA technology to produce insulin with a modified E. coli bacterium.

Ten years later, Pzifer developed the first use in food, developing an ingredient used to make cheese (rennet) through PF – a process that has now become standard.

Currently, state-of-the-art genomic and genetic technology is used to create more and more applications of PF.

Is it GMO?

Startups galore

The main uses however are split into two categories, either applying engineered microorganisms to produce ingredients or using the grown biomass itself as food, feed or materials.

Also see ECBF’s previous Deep Dive on mycelium, which delves deeper into the use of fermentation to produce biomass .

The beauty of PF is that while the organism itself could be genetically modified, the resulting molecule is the same molecule as would have been produced by the organism it was sourced from, or produced through a chemical synthesis.

Then again, the evaluation of the end-product is highly dependent on the applicable regional regulations and the application of the end-product itself, with foods being subject to the most stringent regulation.

When it comes to the EU, Bruno Gautrais, the European Commission’s head of unit dealing with Novel Foods, recently explained the process at an event on cell-cultured food organized by the European Food Safety Administration (EFSA).

He told the audience that when it comes to food produced by PF, “there is no legal definition” for the Novel Foods teams. “There is a need for a case-by-case analysis.”

What is clear is that pretty much all molecules intended for human consumption produced through PF fall under the EU’s Novel Foods regulation.

This regulation stipulates that before such a product can enter the EU market, it first goes through a nine-month (or longer) EFSA process to determine its safety. The EFSA then makes a recommendation to the Commission’s Novel Foods team, which then has seven months to make a decision on the product. This decision is then subject to a vote by member states, and needs the support of a qualified majority to be allowed onto the EU market.

A caveat is that the end-product under review has to be ‘absolutely pure’, so only containing the target molecule and none of the production host’s genetic material.

This caveat is what barred Impossible Food’s hamburger from being allowed on the EU market. The burger, which contains a constituent of animal blood called heme that is produced by genetically modified yeasts, still contained some of the yeast, which led it to be classified as containing a genetically modified organism (GMO) and thus forbidden.

The USA’s FDA, which has a somewhat softer stance when it comes to GMOs, did approve Impossible Burger’s product in 2019.

The past few years have seen a flurry of new startups that use PF.

Roughly, the startups can be divided into three different categories. The first being what feedstock they use as a substrate for their microorganism, the second by the type of product and the third by application of the end-product.

Use of PF in food and beverage application is by far the largest category, following an analysis performed by ECBF and Netzero Insights of PF companies in the EU and Israel. Then it’s possible to look at feedstock, which is the source of carbon that the engineered microorganism uses as a substrate to transform into the target molecule.

Lastly, one can look at the type of product or target molecule produced by a company, e.g. whether that’s a fat, protein or speciality chemical for a specific application.

When it comes to food and beverages, an ECBF analysis found at least 52 European startups using PF.

Eight of these companies focus on using microbes to produce what would be vegan cheese and dairy products.

One example is Dutch startup Those Vegan Cowboys, which is using a modified yeast to produce casein, a protein that makes up most of most cheese. The company is currently in the process of developing ways to scale production and food safety tests.

But they are far from the only ones, with French outfits Bon Vivant and Nutropy, German startup Formo and Swedish company Prefer Food all working on proteins that could be used to produce animal-free cheese.

Other popular food categories are animal-free egg whites and animal-free fats, both for giving dairy a more creamy texture, and as an additive for plant-based meat alternatives –– Swedish Melt&Marble closed out 2022 with a €5m round to develop the latter.

Food additives, more widely, could be a market ripe for disruption thanks to advances in PF.

Biosyntia, an ECBF portfolio startup working on producing biotin (vitamin B7) and thiamine (vitamin B1) more cheaply and efficiently using PF, is one of them, company CEO Martin Plambech explains during the Deep Dive.

Currently, these molecules are either derived from fossil petrochemical sources or from plant extraction, which has obvious disadvantages. Biosyntia uses bacteria as the production organism, and hopes to disrupt the status quo.

According to Plambech, their biotin production process is already 25 times more efficient than the state of the art at chemicals giant DSM, and are now focussed on commercializing and scaling up production.

Venture Dynamics

PF promises animal-free food products with less land use and sustainable, locally sourced and circular materials.

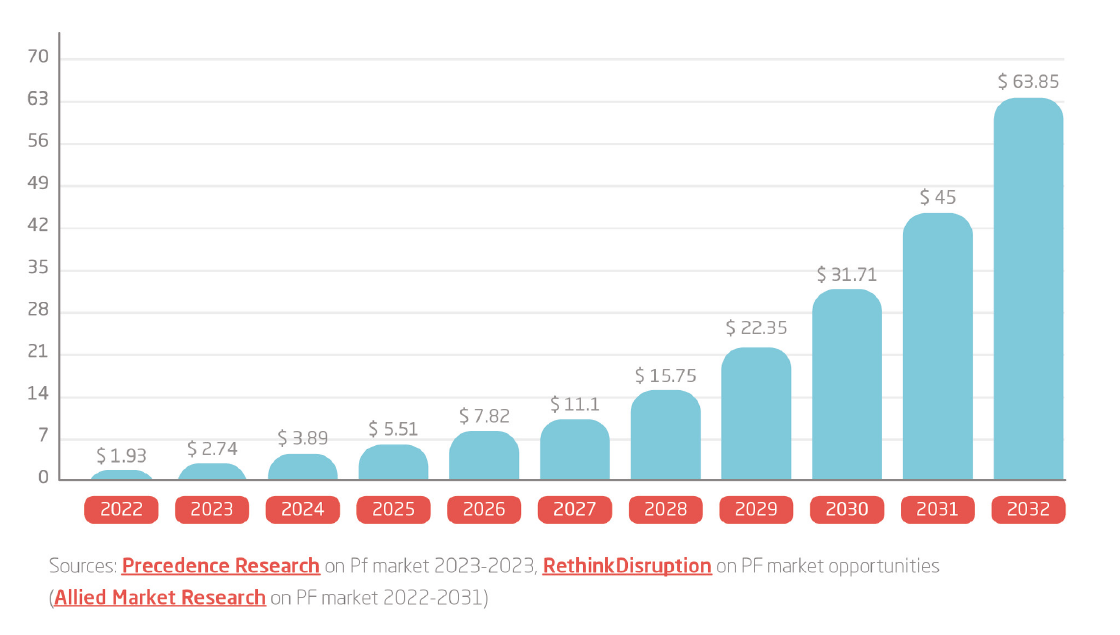

The Global PF Market Size was $1.93 billion in 2022 and is predicted to grow with a CAGR of 41,9%, generating a revenue of $63.9 billion by 2032.

Europe has double the fermentation volume of the US but the same number of CMOs and more large-scale production sites. Germany is a leading hub for PF, followed by Denmark, UK and NL.

There has been a steady increase in PF companies founded over the past 5 years, with a strong uptick starting in 2017 for food and beverage companies. There has also been an increase in PF companies using second generation feedstocks.

Deal counts in PF increased until 2022, which saw 48% of all capital raised in PF across 80+ deals. Amai Proteins, Imaginedairy, Bionsyntia and Chaincraft were outliers (€10m+) in 2022. 2023, in contrast, saw significantly less capital invested.

Corporate investors include Novo Holdings, Cargill, BASF, DSM, and Givaudan, with a number of VC investors investing in PF in Europe as well (Sofinnova, b. Value, Capricorn Partners, High-Tech Gründerfonds).

European investors with precision fermentation focus

2023 saw the founding of two interest groups pushing for policy reform and education; Food Fermentation Alliance Europe and Precision Fermentation Alliance.

Main challenges for PF were found to be 1) scaling up to industrial capacity, 2) sustainability of PF process versus already biobased products, or even sometimes versus petrochemically produced, 3) extensive regulatory pathways for approval, 4) undesirability of first generation feedstocks and 5) limited production capacity.

With second generation feedstock technologies maturing and decreasing in cost, ECBF sees PF as an important enabling technology for the bioeconomy and is actively looking for investment opportunities in the space.

Another additives startup presenting at the Deep Dive was Israeli company Phytolon, which uses yeast programmed with beetroot genes to produce yellow and pink colors.

CTO Tal Zeltzer explains that these colors are currently either artificially produced or extracted from large amounts of fruit and vegetable, and are used to color confectionary products, dairy products and some meat and meat alternatives.

“Natural food colors are plant extracts, which means that specific plants are being grown and harvested for the explicit purpose of extracting the pigment of the food,” Zeltzer says. These plants are then shipped across the globe and processed further to extract the color.

“Per kilogram of product that has been shipped all over the world, just 5 to 30 grams of pigment is extracted, which moreover contains impurities that impact performance,” Zeltzer says.

“With a fermentation product we save these agricultural crops, which can be served as food, reduce sweet water and land use and save on greenhouse gas emissions from shipping,” according to Zeltzer.

PF of food, beverage and food additives therefore holds potential in reducing current greenhouse gas emissions for producing the same exact product.

This same advantage can be gained in other sectors as well.

A number of companies have for example focused their efforts on recreating spider silk – an extremely strong material – through PF.

AMsilk, Bolt Threads and Spiber Inc all use the technique to produce this silk from yeasts or bacteria, with some even reaching limited commercial application in high-end fashion.

The most important technology ever

Guardian columnist and writer George Monbiot called PF “the most important environmental technology ever developed.”

Monbiot writes that the efficiencies that can be gained by using microbes fed on non-food feedstocks to reduce the environmental footprint of food production are nothing short of astounding –– proteins can be produced over 100,000 times more efficiently than using lamb or beef.

He also highlights the fact that fermentation can, in principle, be done anywhere, cutting down the dependency the globe has on shipping food around and eliminating concerns of food insecurity.

Monbiot also lists a number of hurdles that must be overcome before we can embrace this technology to its full potential.

First, overcoming consumer aversion to products produced by microbes. Second, that the end-products could be used to create unhealthy rather than healthy food. Third, genetically modified microbes potentially escaping and running amok in the environment. And finally, and most importantly, the fact that these technologies are at high risk of being developed and captured by corporations unwilling to share in the gained efficiencies.

None of these problems are insurmountable though.

Naturally aritificial

Taking the story back to breast milk and what we feed our most treasured human product ––babies –– apparently we’ve already come so far that we’ve accepted that it’s preferable for our babies to get essential H.M.O.s – even when produced by microbes.

It’s a beautiful thing if you think about it in this context.

It might have taken humans and gut bacteria hundreds of thousands of years of coevolution to get to the point where the body produces exactly the molecules required by the bacteria to help the infant grow a more efficient gut and bigger brain.

And now, as humans, we can make use of that bigger brain to modify or grow bacteria to produce the things we need, in the quantities we need, and restore –– through a completely artificial pathway –– a more natural balance to the world. Just like supplementing ‘artificial’ breast milk with more natural ingredients does for babies.

ECBF’s commitment to the transition to a more sustainable future for consumers, the environment and investors alike, and in-depth analysis of the sector leads us to foresee several investments in the field. We seek to be a significant financial instrument and partner for entrepreneurs looking to unlock and accelerate the economic potential of the circular bioeconomyin Europe, and help create a better and healthier future for everyone.

Authors

-

Jowita Sewerska

Investment Director

-

Jisk de Vries

Associate

-

Bernadette Lee

Junior Analyst