Flying High - Insects to Feed the World

A nutritional powerhouse for the circular bioeconomy

As the world is facing the dual challenge of increasing the output of protein to feed an ever-expanding population, and simultaneously reducing carbon emissions, insect farming is quickly developing into one of the most promising opportunities. As ECBF moves into this rapidly evolving space, this article provides a quick entry into what & who matters.

Protein Challenge

Protein is essential for both direct human consumption as well as for raising livestock and fish. However, the world is facing a major challenge in producing sufficient protein. On present course, the supply of protein from meat and fish – but also plant-based products such as soy – is lagging behind on the increasing demand. Much effort is made to reduce losses in food production but there is nevertheless a need to develop additional protein sources.

One promising protein source that is attracting a lot of attention is insect protein. Farming insects presents an opportunity to convert low-value or waste materials (for example beer-brewing byproducts or supermarket waste) into upcycled, edible products that can be fed to animals, or even consumed directly by humans. It would mean avoiding greenhouse gas emissions from the wastage of these materials, making insect products a potentially very sustainable, circular source of protein. Not least, insect products are highly nutritious and have excellent functional benefits in terms of digestibility, mineral and amino acid composition as well as anti-infective properties.

Insects can be eaten in their mature form (such as the common cricket) but are mostly consumed in their larvae stage – when they are at their most nutritious. Species are selected based on protein content, time to maturity, as well as resistance to disease. Two species are emerging as most preferred: The black soldier fly (BSF) and the mealworm – of which BSF is the one wielding the highest commercial traction in terms of current production capacity. Other species are the lesser mealworm and the housefly, but these will probably remain the lesser used.

The Black Soldier Fly (hermetia illucens) Mealworm (Molitor Larvae)

Nutritional Composition (% of dry matter)

Rearing Cycle (from egg to grown larvae)

Feed Conversion Rate (in Feed)

Feed

Climate

Key Features

30-40% fat

40-50% protein

6 days

23-25%

Single or dual feed application for the whole growing process; better-suited to the composition of typical food waste

Tropical climate

(80% humidity; 30˚C) should be simulated

•Rapid growth rate

•Robust towards diseases

•Feedstock versatile (including waste and manure)

•Reliant on heating/cooling for rearing

35-45% fat

53 -60% protein

8+ weeks

11-23%

Wet food regularly renewed for optimal growth

Moderate climate

(20-30˚C) is sufficient

•Higher protein content

•Better perception for food applications •Long rearing cycle / lower feed conversion •Disease outbreaks reported

A Product Portfolio

Insects are mostly farmed to harvest the protein as well as the oils and fats they produce. They can compete with other sources of protein, such as fish meal, and their composition may even outperform in specific feed and food applications. But like livestock farming in general, to be successful as an insect company it is important to valorize the whole larvae, i.e. the innards as much as the skins that are shed as the animal grows. Industry players are thus required to develop a product portfolio with differentiated product offerings and benefits for different applications (see inset).

For example, the high-protein content insect meal can be used for aquaculture feed, while less refined protein pulp (essentially an insect puree) is suitable for pet food, and live larvae can be fed to chicken – with the added benefit of stimulating the natural hunting-and-gathering behavior, which contributes to their welfare

Insect Derivatives and Applications

At first glance, one would not suspect that frass is a major (by) product that needs to be put to good use to contribute to insect farming economics. The material consists of a mixture of excrements derived from the growing insects, the feeding substrate, parts of farmed insects, as well as dead eggs and insects of no more than 5% in volume and 3% in weight. Opportunely, frass has been found to be a highly valuable fertilizer, with visible benefits on plant health and development due to the antimicrobial activity associated with it – which could aptly stimulate a circular bioeconomy even more.

Driven by Regulation

Any new feed or food source making it into the market must pass regulatory approval, and insects are no exception. Insect farming is considered an agricultural activity, which means they fall under the scope of EU agricultural rules (e.g. EU organic legislation, rural development programs under the Common Agriculture Program). Also, insects farmed in the EU for the production of food, feed or other purposes are considered ‘farmed animals’, covered by Regulation (EC) No 1069/2009 on Animal by-Products, among others.

For the past ten years, the International Platform of Insects for Food and Feed (IPIFF) has lead the effort to establish the necessary regulatory conditions to help its members – current and prospective insect producing companies – become commercially viable. “International standards have been developed to encourage local authorities to implement them,” says Christophe Derrien, Secretary General at IPIFF.

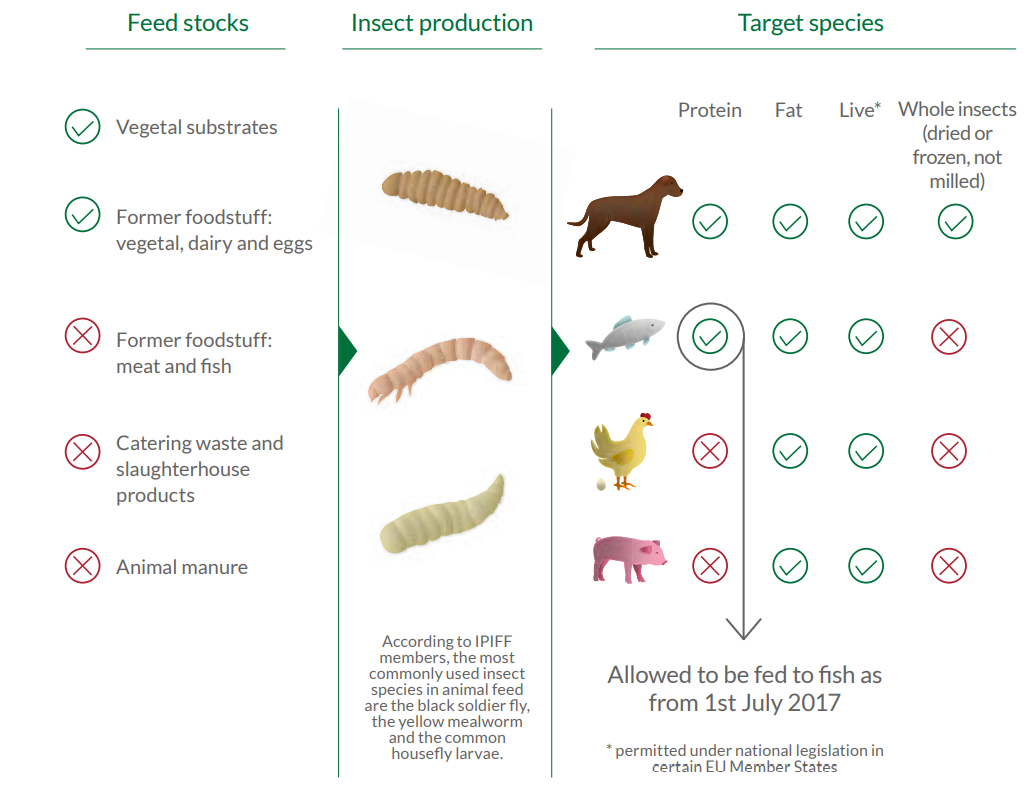

Image 1- EU rules applicable today: insect substrates and the use of insects in animal feed Source: IPIFF Regulatory Brochure - (IPIFF 20 May 2020) - Visual updated in September 2021

The main aim was to get approval for different applications on the one hand (i.e. feeding BSF larvae to chickens or fish, or using mealworm as a novel human food), and on the other to get approval for different waste materials to be used to grow the larvae. A summary can be found in Image 1.

Christophe: “IPIFF has directed the majority of their efforts towards unlocking regulatory barriers to maximize bioconversion of waste-related products under safe and sustainable conditions.” Owing to their experience with Mad Cow Disease, the EU has proven particularly strict in this area, in the sense that it is very hesitant to approve the feeding of animal waste to livestock.

Animal Feed vs Human consumption

Although insect farming is still in its early stages, growing numbers reveal that most of the insect meal produced will be used for livestock and fish feed. And growth can be rapid. IPIFF has forecasted that, by 2030, more than 10% of fish servings consumed in the EU could be derived from fish farms using insect protein in their feed, that 1 in 40 eggs consumed in the EU could be derived from insect-fed laying hens, and 1 in 50 chicken-meat servings could be derived from insect-fed broilers. This would suggest an attractive growth path ahead.

The most superior application may well be the use of feedstock for aquaculture: Fish feed. Boasting excellent nutritional value and amino acid profile as well as antimicrobial activity, leading to very efficient growth rates, for example in salmon, the aquaculture industry would hugely benefit from reducing its reliance on fish meal – which contributes substantially to overfishing our oceans – and switch to insect meal. Despite 99% of insect produce being sold into feed applications, it is the (potential) production of insects for human consumption that always attracts a lot of attention. Indeed, from a functional perspective, insect-based protein is an excellent alternative to traditional choices such as meat and soy, with added benefits on health beyond performance. It has proven to be a complete food source, naturally high in protein, minerals, vitamins, fiber and Omega 3 & 6 – all of which would contribute to a healthy diet.

Potentially, strongly branded concepts could meet consumer search for healthy and sustainable foods. However, insects have to overcome a distinct imaging problem in many markets, and the jury is still out on whether the current crop of insect start-ups can convince consumers to buy insect based foods for mass consumption. At ECBF, we keep an open mind for the opportunity of insects for human food applications, but nevertheless bank on the market for animal feed as the more immediate business and growth opportunity for the insect industry.

Maturing an industry

Inspired by processes occurring in nature, insect farming provides solutions to key European and global challenges, such as food waste, reliance on food imports, and feeding a growing population while limiting the expansion of agriculture – potentially a veritable cornucopia. Indeed, we are currently seeing a true mushrooming of insect start- and scale-ups across Europe and the globe. Or, as one industry observer would say “Every region seems to have its own insect start-up.”

At ECBF we keep track of the various investment opportunities, and have identified well over 25 notable players. That said, the industry is being led by a much smaller number of potential leaders, among which rank Ynsect and InnovaFeed from France, and Protix from the Netherlands. Most recently, ECBF together with BNP Paribas, has made a strategic investment in Protix.

With the industry on a path to maturity, ECBF has identified four key attention points for investors and entrepreneurs alike. First, the ambitious industrial roll-out strategies that are being proposed inherently risk delays and significant cost overruns – which should be mitigated by keen management as well as spare capital. Next, the holy grail for the industry is to achieve pricing parity with fish meal, as this would turn insect meal into a robust, high-volume product – but it is not clear that all players and insect species can achieve such low-cost position. Thirdly, there is the question of differentiation between so many different start- and scale-ups, many of which are focusing on the same BSF species. One should ask if there is room to differentiate, or whether these players can prosper alongside each other in their own region – at least, until the inevitable consolidation takes place. And finally, there is the issue of securing large amounts of feedstock (often >400 kilotons per year) via partnerships, to build the mega-plants needed for scaling up and to secure a profitable, low-cost operation.

As the first venture fund exclusively focused on circular and bio-based industries in Europe, ECBF believes in the potential of the insect industry. It can bring to market a novel protein source which contributes meaningfully to circularity, to reducing carbon emissions, and to generating favorable financial returns along the way. We seek to be a significant financial vehicle and partner for entrepreneurs looking to unlock and accelerate economic potential of the Circular Bioeconomy in Europe, and help create a better and healthier future for everyone.

For questions and comments, please refer to:

Cornelia Mann, Marketing & Communications

cornelia.mann@ecbf.vc

Eugen Kaprov, Associate

eugen.kaprov@ecbf.vc

Peter Nieuwenhuizen, Founding Partner

peter.nieuwenhuizen@ecbf.vc