Picture designed by: Freepik

Biodegradable bioplastics

Insurance against waste or risky shortcut?

When it comes to the rollout of plastics produced from biological sources instead of petrochemical, which can degrade in the environment, many questions remain about the right way forward.

The first Deep Dive of 2023 takes us into the complex yet important world of biodegradable bioplastics; plastic that is 1) created from a biological feedstock and 2) can be broken down by microorganisms into components within a window of time. As the world population and its demand for plastic material grows, it’s abundantly clear a better option than fossil-based plastic must be developed. In this deep dive, we look into the definition of biodegradable biobased plastic, the different types that exist, the regulation that applies to the industry and the venture dynamics of startups in the space.

Executive Summary

Biodegradable bioplastics

Created from biological feedstock and broken down by microorganisms

Global plastic waste problem

11 million metric tons added to oceans yearly, microplastics found in human blood

Bioplastics

Polymers created from biological material, split into three generations based on feedstock sources and production processes

Biodegradable bioplastics

Special category that degrades under specific circumstances into components; the subset includes compostable bioplastics, which – in industrial composting facilities – degrade into water, CO2 and minerals.

Common biodegradable bioplastics

Polylactic acid (PLA), Polyhydroxyalkanoates (PHA), Polybutylene succinate (PBS), starch-based bioplastics, and cellulose acetate (CA)

Biodegradability not always the best end-of-life option in terms of LCA

Recycling often better, some exceptions where biodegradable bioplastics make sense, e.g. when collection is hard or impossible

Picture designed by: Freepik

Regulation

EU focuses on limiting biodegradable bioplastics use, emphasizing recycling of plastics regardless of feedstock, with an additional focus on bioplastics that don’t compete with food/feedstock

Recycling biodegradable plastics

PLA can be recycled, as TotalEnergies Corbion's pilot process in Thailand demonstrates, but due to regulatory time constraints is unlikely to roll out in the EU.

Innovations in biodegradable bioplastics highlighted in this Deep Dive

Gaia Biomaterials' Biodolomer, Lactips' protein-based natural polymer, Outlander Materials' unPlastic

Market growth

bioplastics projected to quadruple within the next decade, mostly stemming from growth in the US and China.

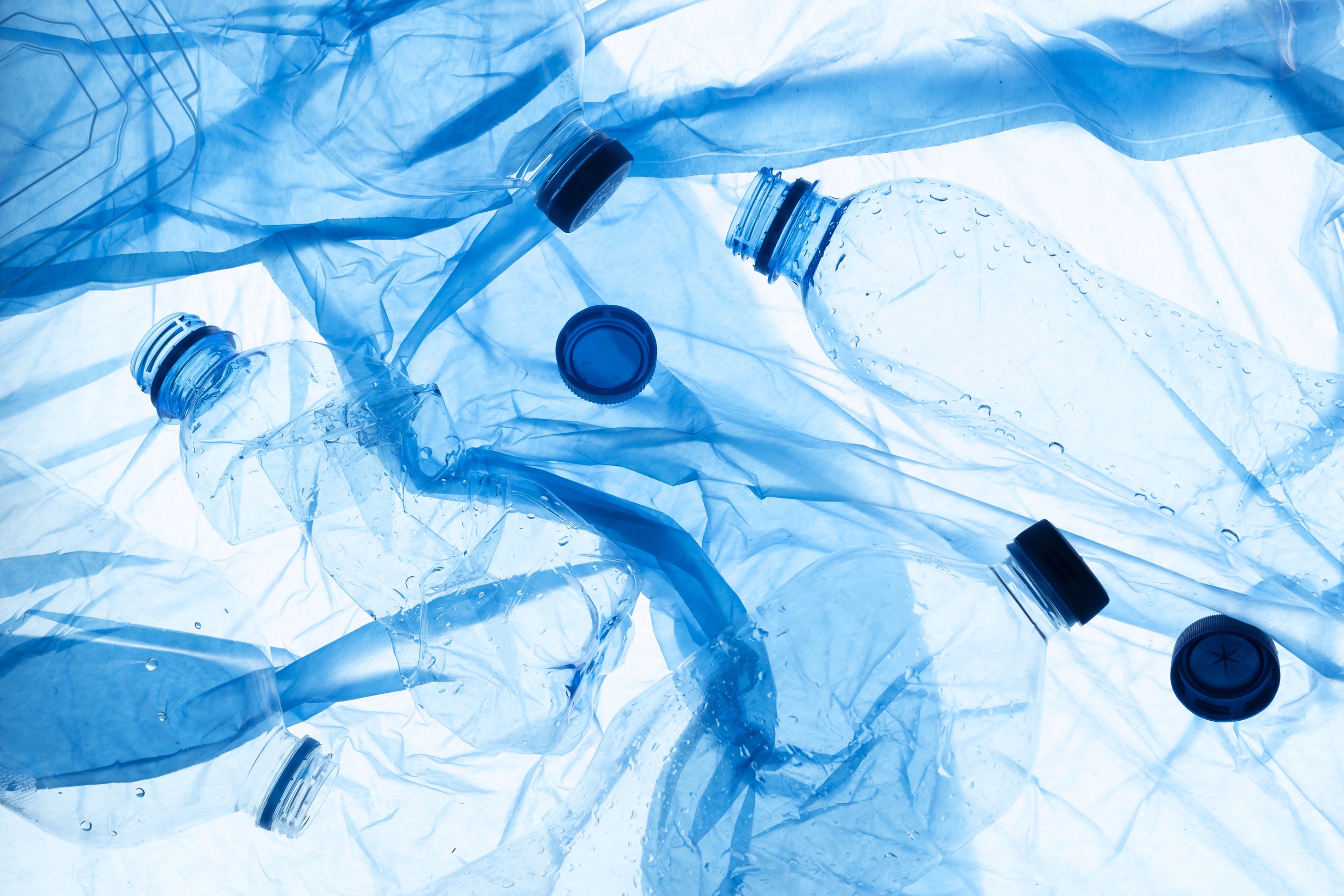

It has been obvious for quite some time now that the world has a problem with plastic waste. Ocean Conservancy estimates that around 11 million metric tons of waste enter our oceans every year – on top of the 200 million metric tons already floating around. Microplastics have been found in human blood.

One of the reasons plastic contamination is so wide-spread, is that it exists in a plethora of different forms, ranging from protective coatings and resins utilized in construction and manufacturing, to artificial fibers composing our garments, to the rubber particles repurposed from tires that cover the soccer fields where our kids play.

Moreover, contact with chemicals found in some plastics, like flame retardants, endocrine disruptors, PFAS, bisphenol A (BPA), and phthalates, has been linked to various potential health consequences.

Plastics are most commonly made using fossil sources.

Put simply, a hydrocarbon, such as oil, is broken down into simpler hydrocarbons, which are separated according to their boiling point. Some of these simple hydrocarbons are then transformed into monomers, the building blocks of polymers, and polymerised into different types of plastic.

Picture designed by: Freepik

Alternatives exist, though

Bioplastics, or plastics created from a biological material rather than fossil hydrocarbons, have been around for as long as plastic exists. They are polymers, just like fossil plastic, and just like with fossil plastic, exist in many different forms. The prefix ‘bio’ does not exclude the use of fossil fuel in its production, as definitions of bioplastic vary from country to country.

Bioplastics are generally categorized based on their feedstock sources and the technological advancements made in their production processes. Currently, three generations are defined.

The first are bioplastics made from foodcrops, such as corn, potatoes or sugar cane. Second generation bioplastics use non-food biomass, such as side-streams from forestry or agriculture. Third generation bioplastics use microbial sources as algae, bacteria, or genetically modified organisms to produce monomers or polymers.

A special category of bioplastics are biodegradable bioplastics, which are both produced from biological sources and can under certain circumstances degrade into water, carbon dioxide and naturally occurring minerals in varying lengths of time.

A subset of biodegradable bioplastics are compostable bioplastics, which fully biodegrade in industrial composting facilities.

Biodegradable bioplastics are designed to break down naturally over time, reducing their environmental impact. Some of the most common types of biodegradable bioplastics include:

Polylactic acid (PLA)

PLA is a popular biodegradable bioplastic derived from renewable resources like corn starch or sugarcane. It is used in various applications, such as packaging materials, disposable cutlery, and biomedical products like sutures and drug delivery systems.

Polyhydroxyalkanoates (PHA)

PHAs are a family of biodegradable polyesters produced by certain microorganisms as a result of their metabolic processes. They have a wide range of applications, including packaging materials, agricultural films, and medical products.

Polybutylene succinate (PBS)

PBS is a biodegradable, aliphatic polyester derived from succinic acid and 1,4-butanediol. It has properties similar to polypropylene and is used in applications such as packaging, disposable cutlery, and agricultural films.

Starch-based bioplastics

These bioplastics are derived from starch, a natural polymer found in many plants. Starch-based bioplastics are often blended with other biodegradable materials to improve their properties and are commonly used in disposable items like cutlery, plates, and cups.

Cellulose acetate (CA)

Cellulose acetate is a bioplastic made by reacting cellulose with acetic acid and acetic anhydride. It is a thermoplastic material with good mechanical properties, and it can be easily processed using techniques like injection molding or extrusion. Cellulose acetate is used in various applications, including eyeglasses frames, cigarette filters, and photographic films.

Picture designed by: Freepik

Biodegradable bioplastics sound great in theory, as they’re potentially non-toxic, break down in nature and don’t need any fossil sources in their production.

But this category of plastic is not always the best choice for every application. In fact, as the founder of nova-Institute Michael Carus told ECBF during the deep dive: “We have problems with microplastics in the sea and the environment, why is biodegradability not considered as an end-of-life option? The answer is easy. It’s very often not the best end-of-life option.”

According to Carus, life cycle analyses (LCAs) have borne out that in almost all cases, recycling is clearly the best option over biodegradation. “That means that if you can collect and recycle, you should do this, and not go to biodegradation,” he said. Plastic that is biodegrading in the open environment produces CO2 and, in wet environments, methane emissions.

There are of course some exceptions, “where it really makes sense, especially when it comes to risk minimisation,” Carus said, “and this is also the understanding of the DG Environment in Brussels,” referring to the EU Commission’s Directorate-General for the Environment.

Using biodegradable bioplastic makes sense when collection is not possible, or does not take place in practice. Caruson gives the example of the weed-wacking string some people use to clear their garden, which slowly dissipates into the environment with use. Other examples could be mulch films, chewing gum, wet wipes, binding yarn and stickers for fruits and vegetables.

Regulation

The European Commission agrees with Carus’s analysis. Dr. Werner Bosmans, who helped develop the Plastics Strategy and the Directive related to single use plastics at the Directorate-General for the Environment (DG Environment), said that EU regulation seeks to limit the use of biodegradable plastics to only those products that cannot be fully collected, separated and recycled.

Speaking on behalf of the commission to ECBF, Bosmans explains that because the biodegradability of different types of plastics is affected by the environment, there are risks involved if these plastics are disposed of improperly.

Picture designed by: Freepik

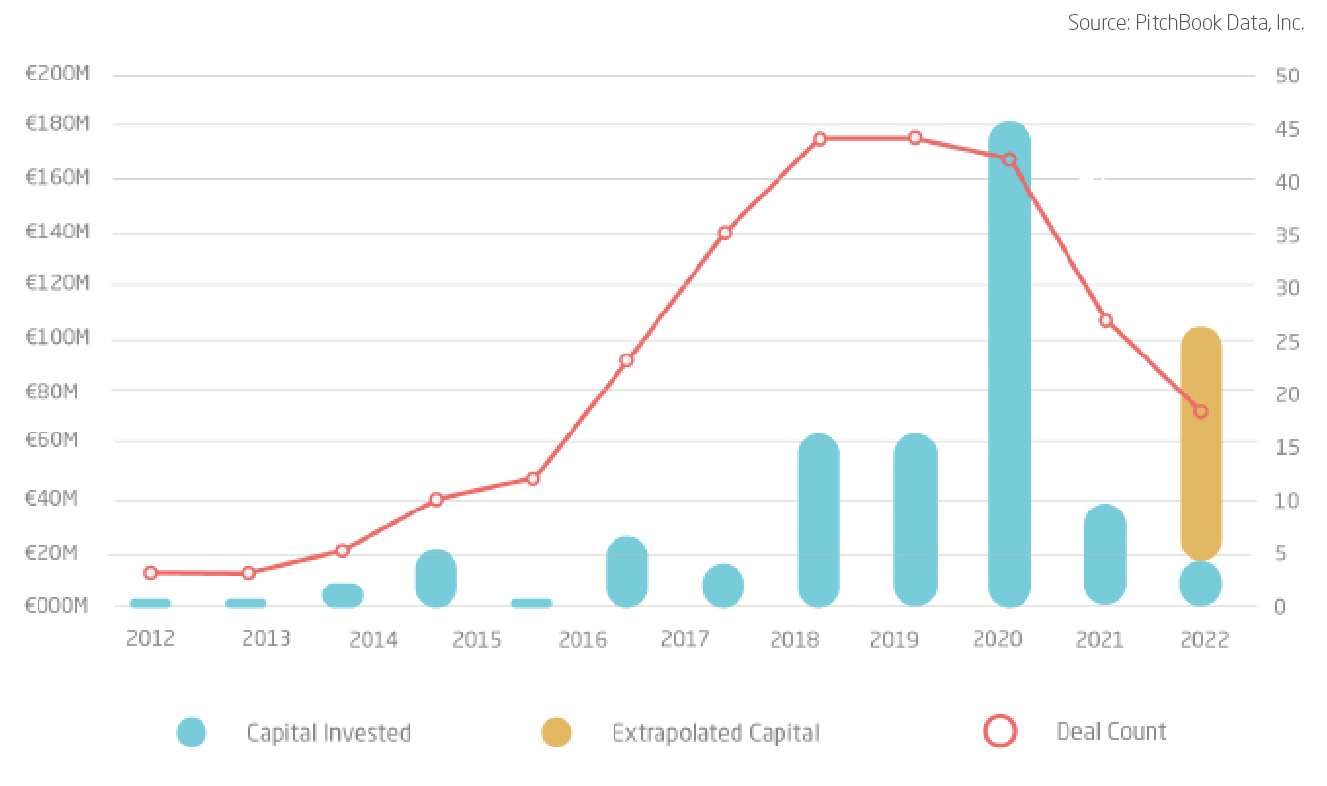

VENTURE DYNAMICS

Bioplastics currently make up one percent of yearly plastic production, but projections show a 400% increase in the global bioplastics market until 2030.

Globally, Europe is emerging as one of the leading regions, with ECBF identifying 92 startups across the continent, with the highest concentration in the UK. Of the startups disclosing feedstocks used, almost one third use either first or second generation feedstock, with another 30 percent using fermentation technology and 11 percent using algae.

ECBF finds no clear investor preference for any specific type of bioplastic, creating challenges in identifying technology leaders. However, worldwide, PHA and PLA dominate the leaderboard of capital raised.

The number of new startups founded peaked in 2019, with a sharp drop-off afterwards, possibly due to a lack of clarity in EU regulation. ECBF sees no clear trend towards high-growth or consolidation.

Since 2012, 282 investors invested €427m across 283 deals. The largest investment was a $70m Series C for Israeli startup TIPA.

Corporates have shown strong interest in European bioplastics, with multinationals investing in companies in the packaging, cosmetics, retail, chemicals, food and electrical and electronics.

EU regulation has become clearer in 2022/2023, with a clear preference for recyclable materials. Biodegradability should be limited to a few categories that are unfeasible or impractical to collect and recycle.

California however passed a new law requiring compostability or recyclability for all packaging products starting in 2032. For the EU, it remains unclear whether composting counts as recycling.

Despite regulatory ambiguity, many startups and ECBF remain convinced that biodegradability can act as a backstop for plastic products with unintended end-of-life scenarios.

“We do not think that biodegradation is something that should be dealt with by the consumers because we're not sure that they will do that in any proper way that will help to reduce environmental impacts, but rather a high risk to the contrary,” Bosmans said. Ideally, there should be no claims of biodegradability on litter-prone objects to avoid confusion.

Same goes for compostable plastics. The commission focuses on industrially compostable plastics, which are plastics that are collected and composted in industrial facilities rather than in bins in people’s backyards.

Moreover, the commission aims to create more clarity when it comes to the way bioplastics are defined in terms of biomass incorporated, and to have a clear priority for second and third generation bioplastics that don’t use feedstocks intended for human or animal consumption.

In line with the European Green Deal and the Circular Economy Action Plan, EU regulation remains staunchly in favor of collecting and recycling in order to maintain the value of products for as long as possible.

Recycling biodegradable plastics?

Which, by the way, is also possible with some types of biodegradable bioplastics. Take PLA, or polylactic acid, a polymer that can be derived from sugar cane or corn starch. As one of the more popular biodegradable bioplastics, PLA has the capability to biodegrade in an industrial composting facility. But more recently, research has shown that PLA offers possibilities for recycling as well.

For certain applications of PLA, such as for cups or cosmetics packaging, the plastic is unlikely to end up in organic waste collection, but if designed well, can be recycled.

TotalEnergies Corbion has piloted a process in one of their recycling plants in Thailand, that allows used PLA packaging to be shredded, cleaned and hydrolysed back into its composite polymers, which allows it to be used again to create so called ‘virgin’ PLA.

The process is not perfect yet, however. As François de Bie told ECBF, “We're not at 100% yet, but we can offer commercial grades which have 20% recycled content.”

Inspired by the egg

Gaia Biomaterials from Helsingborg in Sweden uses the PLA produced by TotalEnergies Corbion in the production of their biodegradable compound that was, according to founder Konrad Rosèn, inspired by the egg.

“When you think about perfection, perfection is achieved not when there’s nothing left to add, but there’s nothing left to take away. And that is always how we think about the egg, and how we think about our new compounds,” Rosen told ECBF.

The company developed a polymer compound called Biodolomer, “based on calcium carbonate, like the egg, which consists of 90% calcium carbonate.” The calcium carbonate is mixed with varying levels of polymers like PLA and PBAT (a fossil-based biodegradable polymer) to create different blends with varying properties.

Plastic, not plastic

Another more creative approach to producing a biodegradable bioplastic for use in applications that are usually thrown away, such as paper packaging and labels, is to not be considered a plastic at all.

One of the startups speaking to ECBF, Lactips, started as an academic project in 2007, and now has a completely developed technology for a drop-in solution that is “natural, hydro-soluble and biodegradable,” according to founder Alexis von Tschammer. And is not considered a plastic.

Lactips produces a protein-based, natural polymer that does not add any chemicals –– excluding the product from EU regulations like the Single Use Plastics directive and chemicals regulation REACH. “It can in fact be used for single use, as it’s considered natural,” von Tscharmer said.

The company recently inaugurated an industrial scale plant in Gier Valley, near Lyon in France, which is ultimately set to produce 10,000 tons of pellets per year.

One issue with the product might be that it uses casein, an animal polymer material that is used as a food source, possibly putting the plastic in competition with food use. Von Tscharmer said that they are looking into fermentation-produced casein as a possible replacement.

Valorising waste streams into polymers

In comparison, another startup presenting for ECBF, Outlander Materials, uses glucose-rich side-streams from food production, such as the liquid fraction of beer brewing waste. But COO Francois Schokaert says that the startup has expanded the input to “basically any low-value, sugar rich side-stream of the food industry can be used.”

The product they produce is called unPlastic, which according to Schokaert is a fully-compostable biopolymer that can be used as a transparent plastic film. The company has a patent pending, and plans the installation of a pilot facility at the end of 2023.

Bioplastics futures

As of yet, bioplastics of any kind represent less than one percent of the more than 390 million tons of plastic produced annually. But the market is projected to grow quickly over the coming years, quadrupling in size within the next decade, according to Pitchbook data.

When it comes to biodegradable bioplastics, the jury is still out. While biodegradability sounds like a good insurance policy against improper disposal, the myriad uses of plastic materials virtually ensures that at least some biodegradable plastic will end up in conditions that are non-ideal for degradability.

And with the regulatory superpower of the EU frowning on the use of biodegradable plastics except for the most necessary use cases, questions remain about the viability of some of the players in the industry.

Then again, thanks to startups innovating the materials and applications, there might be a future in which the tides turn, and biodegradability becomes a more desired end-of-life option for more materials.

ECBF’s commitment to the transition to a more sustainable future for consumers, the environment and investors alike, and in-depth analysis of the sector leads us to foresee several investments in the field.

We seek to be a significant financial instrument and partner for entrepreneurs looking to unlock and accelerate the economic potential of the circular bioeconomy in Europe, and help create a better and healthier future for everyone.

Authors

-

Guillaume Gras

Investment Director

-

Hakan Karan

Associate

-

Tommaso de Santis

Junior Analyst